The New Responsibility of Financial Infrastructure

If you are building a payment processing platform, a stablecoin issuance service, or any B2B financial infrastructure, you are no longer just a conduit for moving money. You are the gatekeeper of an entire ecosystem. Your downstream customers—the fintechs, merchants, and dApps building on your APIs—rely on you not just for uptime, but for integrity.

The challenge is immense. How do you provide institutional-grade security and compliance to a diverse set of customers at scale? How do you stop sophisticated fraud and money laundering within your network without adding crippling latency or forcing a one-size-fits-all policy onto everyone?

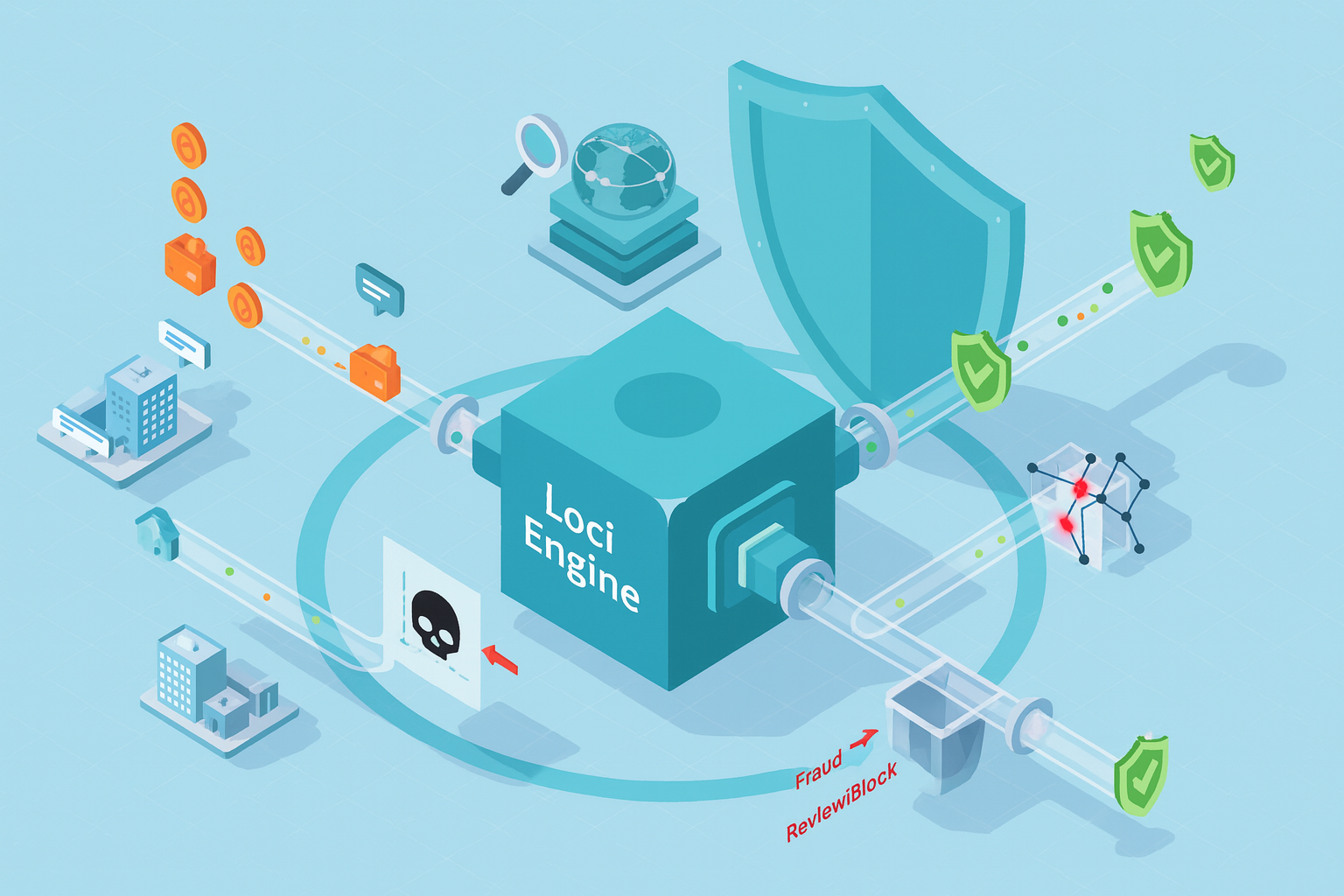

The answer is to stop thinking of compliance as a centralized cost center and start treating it as a decentralized, embedded feature. This article outlines how infrastructure platforms can leverage Loci's embedded intelligence engine to provide "Compliance-as-a-Service," turning a complex obligation into a powerful competitive advantage.

From Gatekeeper to Enabler: Compliance as a Product

For too long, the model for infrastructure providers has been to perform basic checks and pass the bulk of the compliance liability downstream. This is no longer tenable. The most successful platforms of the next decade will be those that build trust directly into their core product.

By embedding Loci, you transform your platform. You can now offer tiered, sophisticated compliance suites directly to your customers, creating a new, high-margin revenue stream. Imagine offering a "Pro" plan to your clients that includes real-time Account Takeover prevention, or an "Enterprise" plan that provides them with detailed network analysis of their own user base.

This is the future: Compliance as a Product, powered by an embedded, multi-layered intelligence engine.

The Engine of Trust: Loci's Real-Time, Multi-Layered Intelligence

You do not need another rules engine; what you need is a comprehensive security intelligence platform designed to be embedded within your infrastructure. Our high-speed engine ensures that even with multiple layers of analysis, your transaction latency remains in the milliseconds. Here’s how our core intelligence pillars can be exposed to your downstream customers.

1. Geolocation Analysis for Ironclad Account Security

Account Takeover (ATO) is a threat to every single one of your downstream customers. By integrating Loci's GeoRisk Intelligence Service, you can offer them a near-deterministic defense against it.

How it works: With every API call (e.g., a login, a payout request), your platform can be enriched with Loci's contextual signals. Our engine detects physically impossibleTravel events, flags suspicious new devices, and assesses IP reputation.

Value to your customer: A fintech building on your platform can now instantly block a fraudulent withdrawal attempt originating from a compromised account, because your API told them the session was high-risk. You provide this security as a native feature of your infrastructure.

2. Behavioral Baselining and Pattern Recognition

Fraudsters rely on exploiting static, predictable rules. Loci allows you to offer dynamic, behavioral defenses.

How it works: Loci's engine is built to recognize complex patterns and compare activity against historical norms. Using our transparent Fraud Language Model (FLM), you can build sophisticated templates for your customers, such as rules that detect "smurfing" (structuring) or high-velocity attacks across rolling time windows.

Value to your customer: A merchant using your payment gateway is now protected from a stolen card being used 20 times in 5 minutes, because your infrastructure's embedded Loci engine detected the anomalous behavioral pattern.

3. Entity Relationship Graph Analysis (The "God's Eye View")

This is the most powerful capability for an infrastructure provider. While each of your customers sees only their own transactions, you see the entire network. And with Loci, you can productize that view.

Value to your customer: Your platform can now offer a "Network Risk API." A stablecoin issuer using your infrastructure could check the Loci-powered risk score of a wallet before allowing a deposit, protecting their own ecosystem from funds originating from a money laundering ring that you, the infrastructure provider, were able to identify at a network level.

The FLM: A Unified Language for Your Ecosystem's Policies

The Fraud Language Model (FLM) is the transparent, auditable language that underpins this entire system. It allows you to:

Set Master Policies: As the infrastructure provider, you can create and enforce a baseline set of compliance and security rules that apply to every transaction on your platform.

Enable Customer Customization: For your more advanced customers, you can provide access to Loci's no-code Visual FLM Studio, allowing them to build and layer their own specific business logic on top of your master policies.

The Business Case: Why Embedded Compliance is Your New Moat

Embedding Loci's intelligence into your platform is a strategic investment with clear returns:

Attract Higher-Value Customers: The most sophisticated fintechs and institutional players will actively seek out infrastructure that has robust, built-in compliance.

Create New Revenue Streams: Move beyond simple transaction fees and sell premium, high-margin "Compliance Suite" or "Fraud Shield" packages.

Reduce Your Own Systemic Risk: Proactively identify and manage high-risk clients on your platform before they can cause a catastrophic regulatory or reputational event.

Lower Fraud Rates for Everyone: By providing world-class security to all your downstream customers, you create a stronger, more trusted ecosystem, which benefits everyone.

The future of payment and stablecoin infrastructure is not just about moving value faster. It's about moving value safer. By embedding Loci's intelligence engine into your core, you can become the trusted foundation on which the next generation of finance is built.

Ready to turn compliance into your competitive advantage? Book a Demo to learn how Loci can become your embedded intelligence partner.